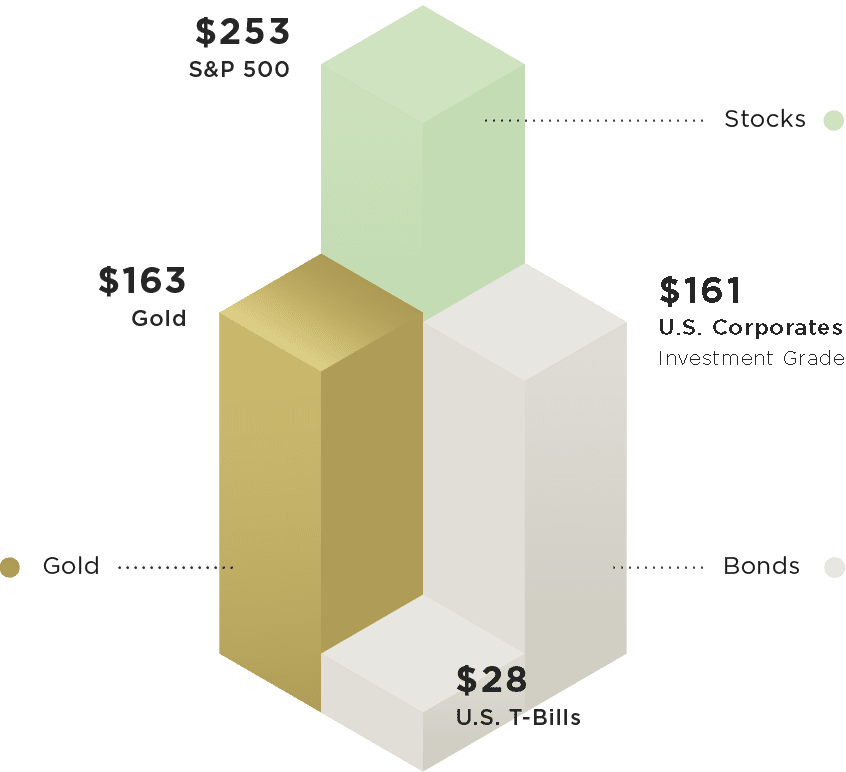

A Highly Liquid Asset

Liquidity of assets is key when constructing an investment portfolio. Often, alternative investments like real estate and collectibles have limited liquidity within their markets, making it difficult or more costly to monetize gains in a crunch. Gold is a highly liquid asset, easily traded globally with transparent pricing and consistently high demand across physical markets, exchanges, and financial institutions. This allows investors to quickly convert gold to cash without significantly impacting its market value. Gold also maintains its liquidity during financial crises, making it a stable option for large, long-term investors. In fact, compared to other highly liquid assets, like US bonds and stocks, gold offers similar liquidity.

Average Daily Trading Volumes of Major Assets

US$ Billions/Day

From 2022–2023, gold has been the second most liquid asset following S&P 500 stocks.

Source: World Gold Council. Average daily trading volumes of various major assets in US dollars, based on estimated one-year average trading volumes from 01 January 2023 to 31 Dec 2023, except for currencies that correspond to April 2022 daily volumes due to data availability. *Gold liquidity includes estimates on over-the-counter (OTC) transactions and published statistics on futures exchanges, and gold-backed exchange-traded products.